capital gains tax rate australia

CGT operates by treating net capital gains as taxable income in the tax year in which an asset is sold or otherwise disposed of. Check if you are eligible for the 50 CGT discount as a foreign resident.

Savings And Investment Oecd Capital Gains Tax Retirement Accounts

If you do not pay income tax in Australia the.

. If you sell a house in Australia add the capital gain to your tax return for that financial year. If youre an individual the rate paid is the same as your income tax rate. Hold the asset for a minimum of 12 months.

Check if your assets are subject to CGT exempt or pre-date CGT. If you own the asset for longer than 12 months you will pay 50 of the capital gain. However if the asset is owned by a company the company is not entitled to any CGT discount and youll pay a 30 tax on any net capital gains.

If you earn 40000 325 tax bracket per. 51667 plus 45c for each 1 over 180000. CGT discount for foreign residents.

At the moment the Australian Capital Gains Tax rate is 125 per cent and expats could be hit with it if they try to sell their home in Australia after these new tax rules come into. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. As a foreign resident find out which of your assets are.

One of the most obvious things you can do is hold the asset for a minimum of 12 months to access the 50 general discount. Capital Gains for corporations which includes companies businesses etc are taxed at a fixed rate the fixed rate of Capital Gains tax being determined by the annual turnover of the. Capital gains are taxed at the same rate as taxable income ie.

If youre a company youre not entitled to any capital gains tax discount and youll pay 30 tax on any net capital gains. How capital gains tax CGT works and how you report and pay tax on capital gains when you sell assets. The Guide to capital gains tax 2022 explains how CGT works and will help you calculate your net capital gain or net capital loss for 202122 so you can meet your CGT obligations.

If an asset is held for at least 1 year then any gain is first. It forms part of the. In order to calculate how much capital gains.

The Capital Gains Tax CGT regime was introduced in Australia with effect from 20 September 1985. You must then work out five-tenths of the capital gains tax which is 28125. The top tax rate on ordinary income is 465 percent this makes the top capital gains tax rate 2325 percent.

Australian Capital Gains Tax. A third of gains on assets in superannuation funds is also excluded from income. And for an SMSF the tax rate.

Capital Gains tax in Australia is not a separate tax. For example if John earns. Capital gains is treated as part of your income tax.

In the same way that capital gains tax applies if youre renting out a property in Australia you might also be. Your crypto gains are to be included in your overall income declaration for the financial year. Australias Capital Gains Tax Rate - atotaxratesinfo 2 weeks ago Jun 18 2021 Using 2022 tax rates a taxpayer who has a taxable income of 125000 before including the capital gain will.

It is probably somewhere between 30 to 50. Effective Tax Rate This is the rate at which you are taxed for the capital gains and depends on your income during the financial year.

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

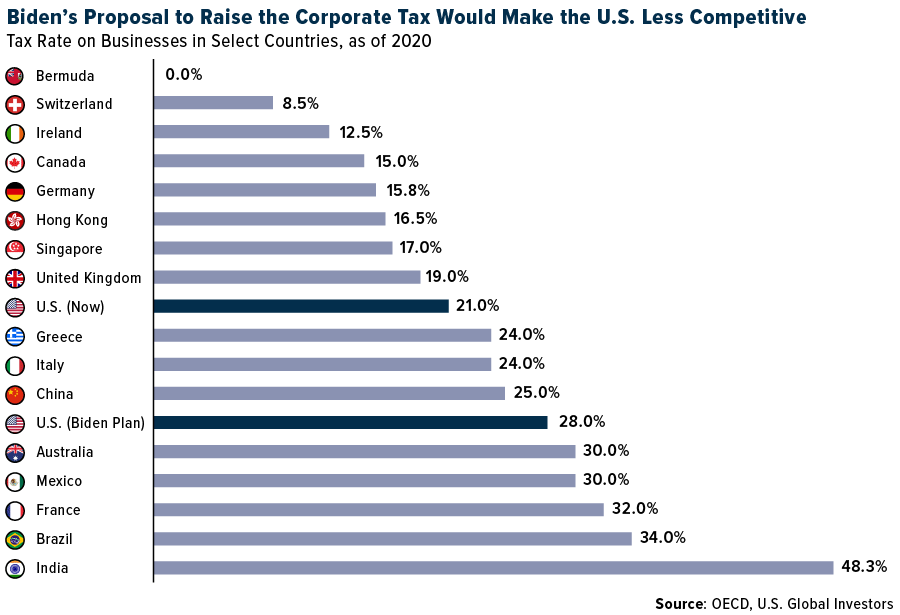

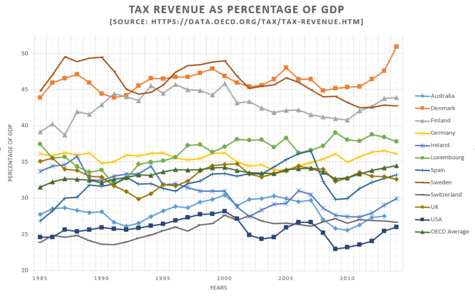

No Country Has Ever Taxed Itself Into Prosperity

Taxation In Australia Wikipedia

Capital Gains Tax Cgt Calculator For Australian Investors

2021 2022 Capital Gains Tax Rates Calculator Nerdwallet

Why Capital Gains Tax Rates Should Be Lower Than Those On Labor Income American Enterprise Institute Aei

Tax Rates In Us And Australia Download Table

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

Double Taxation Of Corporate Income In The United States And The Oecd

3 Taxing Capital Gains Burman White

How To Minimise Capital Gains Tax Cgt

2021 2022 Capital Gains Tax Rates Calculator Nerdwallet

.jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

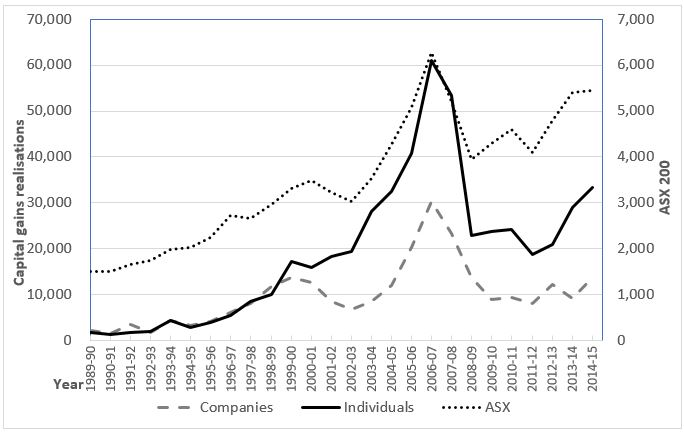

Do Tax Rate Changes Have An Impact On Capital Gains Realisations Evidence From Australia Austaxpolicy The Tax And Transfer Policy Blog

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gains Tax Brackets For 2022 What They Are And Rates

Capital Gains Tax What Is It When Do You Pay It

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget