nevada estate tax rate

So all things considered. Use Tax applies to mail order out-of-state toll-free 800 numbers purchases made on the internet and other purchases of tangible personal.

City Of Reno Property Tax City Of Reno

The Nevada state sales tax rate is 685 and the average NV sales tax after local surtaxes is 794.

. Creighton said any digital goods tax needs to be equitable because its about taxing a product digitally at the same rate whether you are buying a book in a local shop or digitally. For instance Louisiana currently has the fifth-lowest property tax rate in the US. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

California has 2558 special sales tax jurisdictions with local sales taxes in. Counties and cities can charge an additional local sales tax of up to 25 for a maximum possible combined sales tax of 10. Letss assume the estate tax exemption is still 114 million when Dora dies.

No other state near the left-coast falls in the top 10. Maryland is the only state to impose both. Most importantly if you want to live out West.

Groceries and prescription drugs are exempt from the Nevada sales tax. Counties and cities can charge an additional local sales tax of up to 125 for a maximum possible combined sales tax of 81. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

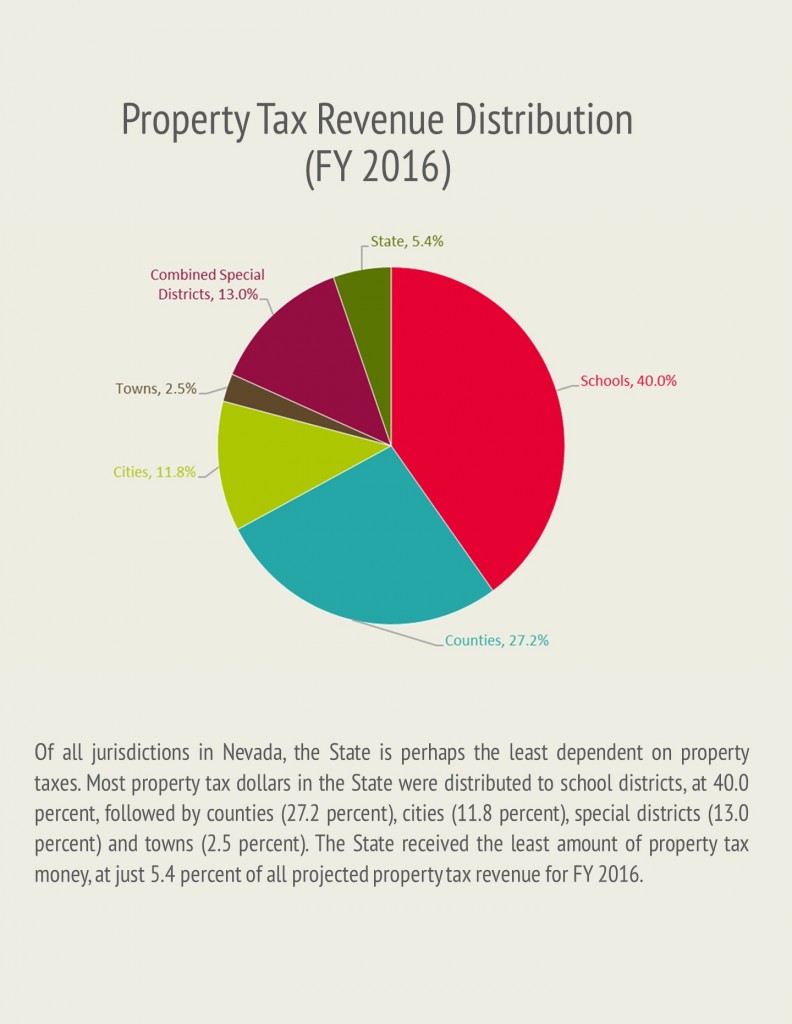

Twelve states and Washington DC. It shows Nevada has one of the 10 lowest real estate tax rates in the nation. Explore our list below to see the 10 states with the lowest property taxes by their average effective property tax rate.

The Tax Foundation is the nations leading independent tax policy nonprofit. Phils 1158 million estate tax exemption was unused and Dora cannot claim the exemption without portability so Dora can only use her exemption of 1158 million when she passes away. Their decision is final once determined.

Nevada has 249 special sales tax jurisdictions with local sales taxes in. Impose estate taxes and six impose inheritance taxes. Nevadas unemployment rate remained stubbornly high.

Nevada has a 685 percent sales tax rate and a max local rate of 153 percent with an average combined state and local sales tax rate of 823 percent. And at 4 it also has one of the lowest sales taxes in the country as well while its state income taxes range between 2 and 6. Directors may determine the value of any transactions.

Groceries and prescription drugs are exempt from the California sales tax. And the job. Since 1937 our principled research insightful analysis and engaged experts have informed smarter tax policy at the federal state and global levels.

Corporations may issue stock for capital services personal property or real estate including leases and options. Nevada also imposes a Commerce Tax on businesses with Nevada gross revenue exceeding 4000000 within a taxable year. On the other hand when the economy is good.

For the most part Use Tax rather than Sales Tax applies to property purchased ex-tax outside of Nevada for storage use or other consumption in Nevada from other than a seller registered in Nevada. Thus the estate tax rate is 40 and Doras estate is still worth 20 million. The California state sales tax rate is 75 and the average CA sales tax after local surtaxes is 844.

Nevada Property Tax Calculator Smartasset

Taxes In Nevada U S Legal It Group

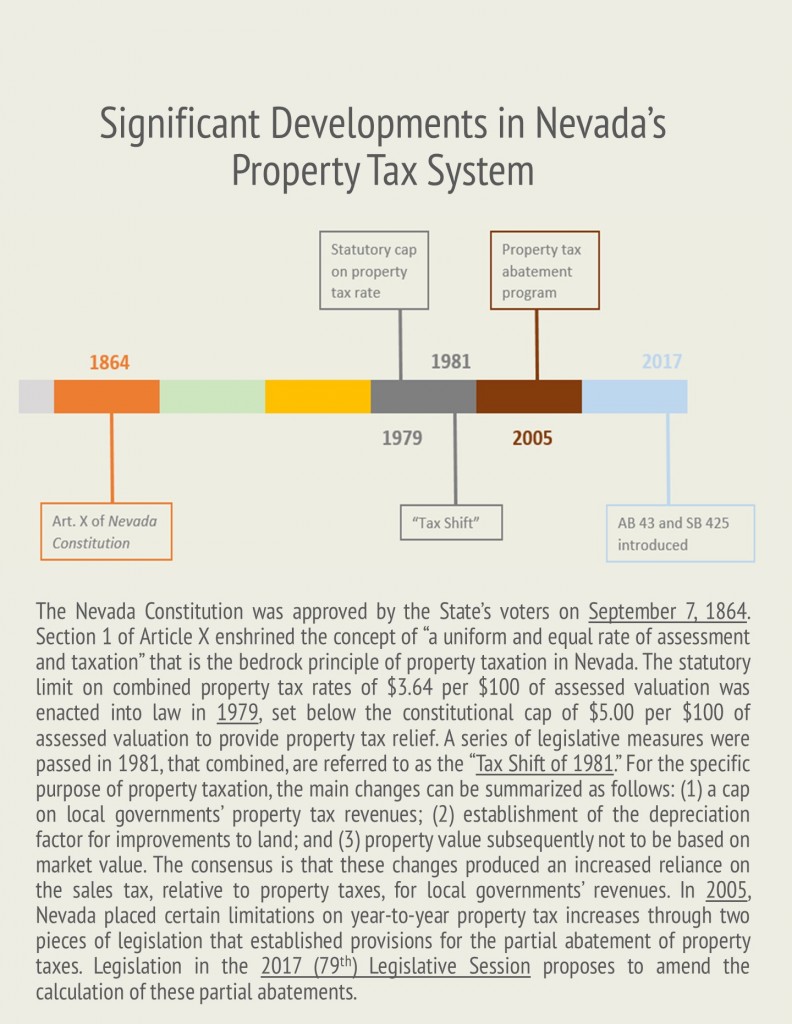

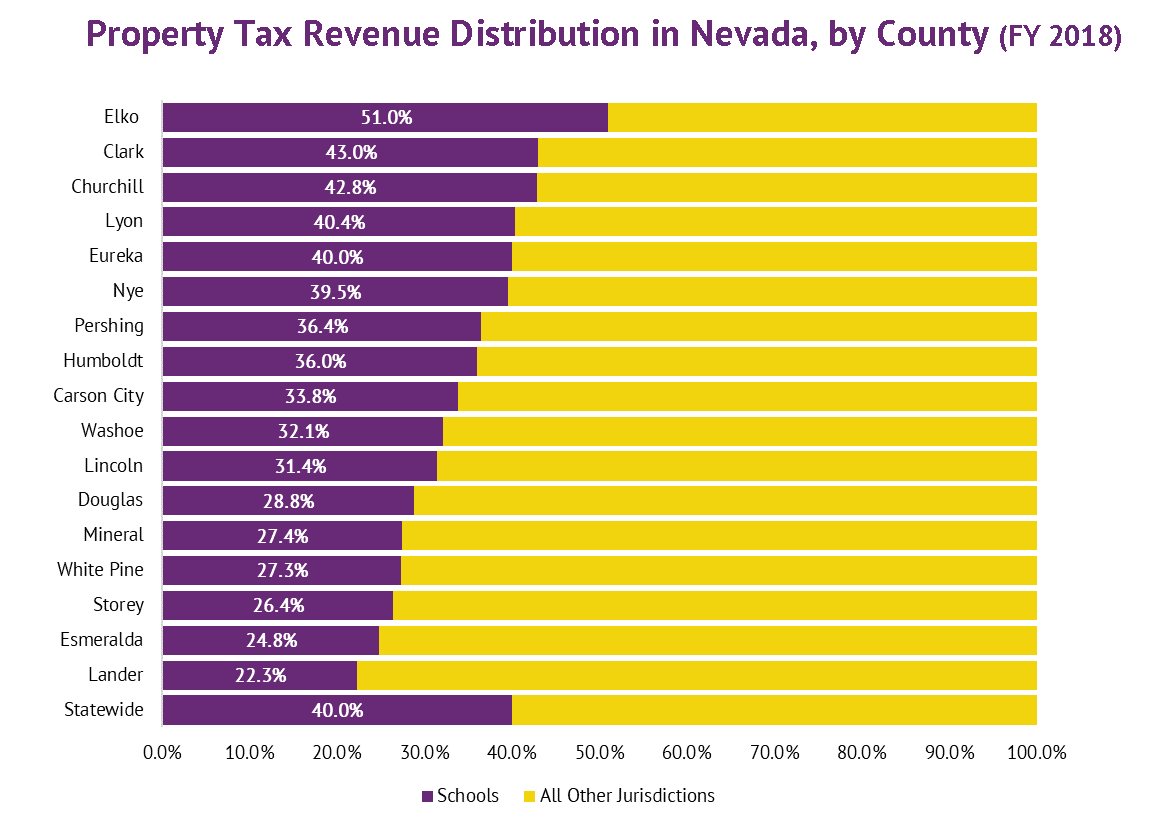

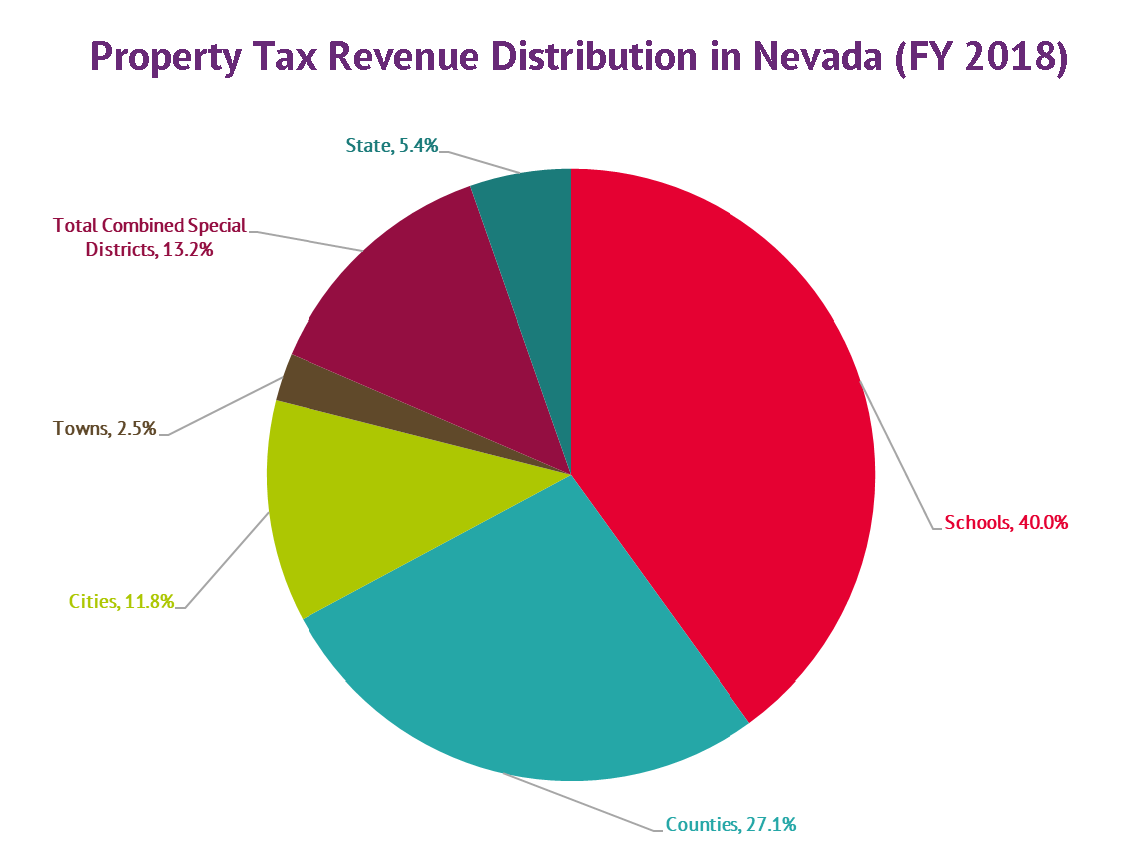

Property Taxes In Nevada Guinn Center For Policy Priorities

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Property Taxes In Nevada Guinn Center For Policy Priorities

Taxpayer Information Henderson Nv

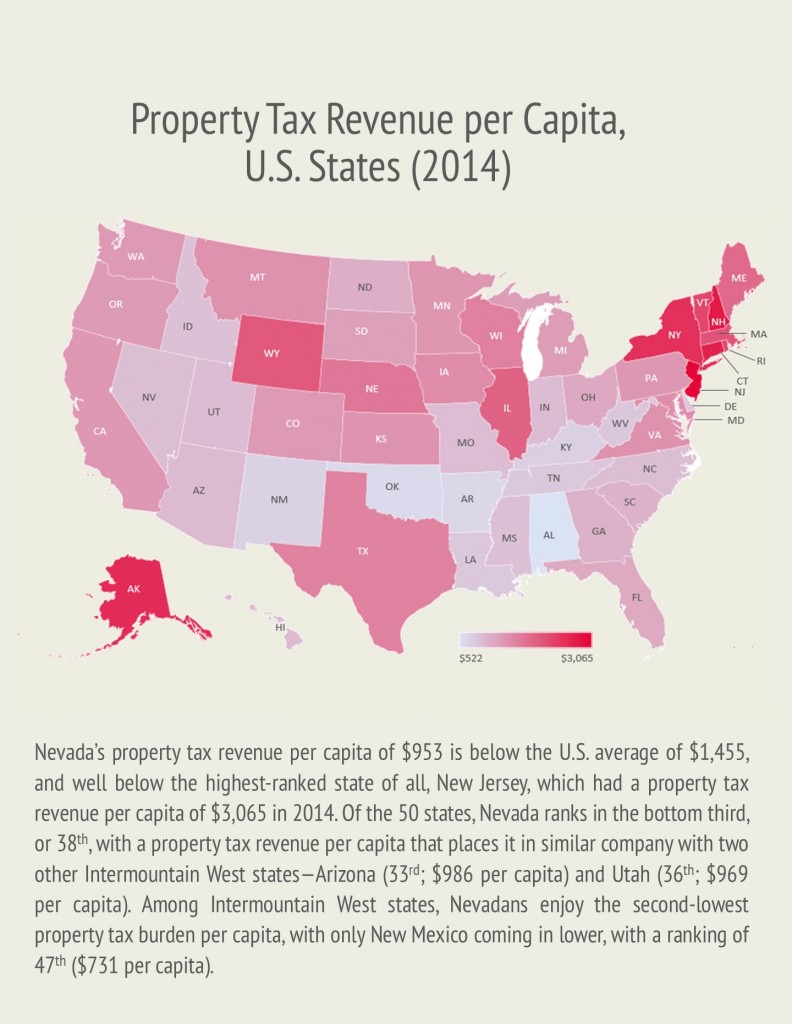

Property Taxes K 12 Financing In Nevada Guinn Center For Policy Priorities

Property Taxes In Nevada Guinn Center For Policy Priorities

The 10 Best States For Retirees When It Comes To Taxes Retirement Retirement Locations Retirement Advice

Nevada Vs California Taxes Explained Retirebetternow Com

Nevada Tax Rates Rankings Nevada State Taxes Tax Foundation

Property Taxes K 12 Financing In Nevada Guinn Center For Policy Priorities

Congrats To My Relocation Clients Moving Back To Stl From Nv Who Just Closed On This Cutie In Ste Gen I Am Super Excited For T In 2022 House Styles Realtors Realty

Property Taxes In Nevada Guinn Center For Policy Priorities

Taxes In Nevada U S Legal It Group

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Property Taxes K 12 Financing In Nevada Guinn Center For Policy Priorities

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)